Mortgage insurances: How MLTA differs from MRTA

Many people dream of owning a home some day and many diligently save up for it. But one thing people must remember is that getting the keys to their own home is not the endgame.

In the unfortunate event that they are no longer around to pay off the loan, it is important to make sure that their investment is properly protected.

Based on a 2019 survey by statistical data provider Statista, 18.26% out of 1,101 respondents did not own any life or medical insurance. This means that without sufficient savings, their families would find themselves in financial trouble should anything untoward happen to them.

“Most of the mortgage tenure these days range up to 30-35 years. 30-35 years is a long time and should unforeseen pre-mature death or disability happen along the way to the borrower, the surviving family members (spouse, parents, children etc) will need to carry on with this debt until it is fully repaid,” Billy Teoh, partner of financial planning group IPPFA Sdn Bhd, told Property Advisor.

Jared Lim, co-founder of loanstreet.com.my, a portal that brings information together for various financial products, noted that it was important to take a mortgage loan for a property if your dependents are living there, to ensure that they still have a roof over their heads should anything untoward happen.

“However, if it is an investment property, or you have no dependents, then it is less important because it can still be sold off with minimal impact to you or your dependents’ lives,” he said.

Teoh said, “Normally banks will offer mortgage insurance together with the mortgage. However, it is not compulsory for the borrower to take up this mortgage insurance from the bank.”

He added that more needs to be done to educate Malaysians on the importance of mortgage insurance and the different options available to them, instead of hearing it only from their banks.

Difference between MLTA and MRTA

The most common mortgage insurances are MLTA (Mortgage Level Term Assurance) and MRTA (Mortgage Reducing Term Assurance). But how do you choose and is it really necessary if you already have life insurance?

It is important to first understand the difference between the two mortgage insurances, and also your priorities.

An MLTA offers not only protection for the amount of your outstanding home loan, but also functions as savings since the amount insured will be consistent throughout the duration of the loan.

Similar to life insurance, you can name anyone as your beneficiary, so if anything untoward happens to you, your beneficiary can use the payout for other urgent needs such as medical bills.

Another way in which MLTA is similar to life insurance is you pay a monthly or annual premium, which can come to a total of six digits by the time the tenure ends.

Cost-wise, an MRTA is more affordable, however, it only covers the money owed to the bank in taking your home loan. The sum assured decreases over time as more and more of your loan is paid off, and the sole beneficiary is the bank as it is meant to pay off your home loan in the event of unfortunate circumstances like death or total permanent disability.

The premium for an MRTA is paid as a lump sum and can usually be bundled into the home loan.

However, an MRTA is dependent on the loan amount and interest rates at the time of purchase.

This means that if interest rates go up, your family may have to fork out more money since the MRTA’s value has declined lower than the remaining loan value since the date of purchase.

Furthermore, for an MRTA, you will not get any money back after paying off the loan. On the contrary, if you decide to take an MLTA, you can receive a no-claim cashback, which allows you to get back 100% of the total premium that was paid over the years.

Another interesting point to note is that an MLTA is easily transferable, which makes it the superior choice for investment properties.

Since it is not tied to a specific property, you can easily sell off a property and replace it with another under the same MLTA.

The flexibility of the MLTA protection value allows you to adjust up or down anytime you desire.

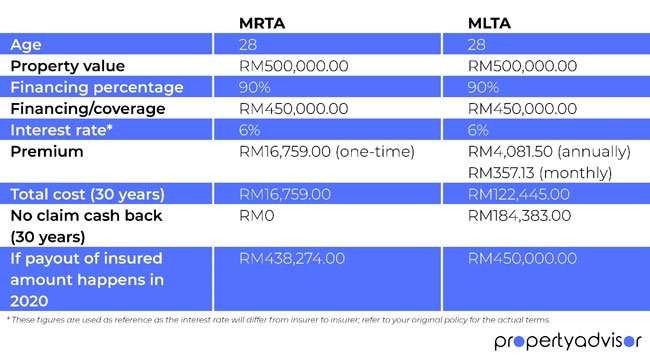

Here is a comparison of the estimated payout between MRTA and MLTA based on insurance cover

for the sum of RM450,000 using 6% interest over 30 years starting in 2018 for a 28-year-old homeowner.

Is it still necessary for those who have life insurance?

According to Lim, “If a person already has life insurance, it might not be necessary, ONLY IF it is sufficient for your dependents to pay off the mortgage and still have enough to get by on a day-to-day basis.

“But financial planning wise, it is better to have life insurance for the purpose of your dependent’s day-to-day subsistence, while having a mortgage insurance just to cover the mortgage for the home.

“If you already have sufficient life insurance, MRTAs for the mortgage should be enough. If you don’t have life insurance yet, you can consider getting MLTAs, as it is similar to life insurance policies.”

Teoh echoed Lim’s sentiments, saying that different life insurance policies serve different objectives and purposes. “If the life insurance of a sole breadwinner is used to cover his mortgage, there is no leftover for his surviving spouse to support the family going forward.”

Alternatively, Teoh highly recommends a level-term insurance as mortgage insurance.

“More insurance companies have come up with limited payment investment-link insurance as a supplement to mortgage insurance.”