Our Services

Stay Connected

How We

Can Help?

The role of a financial consultant is to carry out his duties for his clients with diligence. Every client has a unique financial situation. Right at the start, we would take time to get to know you, find out about your needs and your desired goals. Then from here, we would develop a comprehensive financial plan that will empower you to turn your dreams into reality.

There are 4 areas we will look into when it comes to planning your finances:

- Investment Planning

- Risk Management

- Asset Management

- Estate Planning

With this, we will propose specific recommendations to help you work towards your desired goals.

We will also do periodic reviews of your portfolios to keep you updated of your financial situation.

As your trusted personal financial adviser, we will share what you need to know, instead of what you want to hear. By doing this, we believe not only you will be abled to make wise decision to address the changes in your life, but also to seize the opportunities in the current economic conditions.

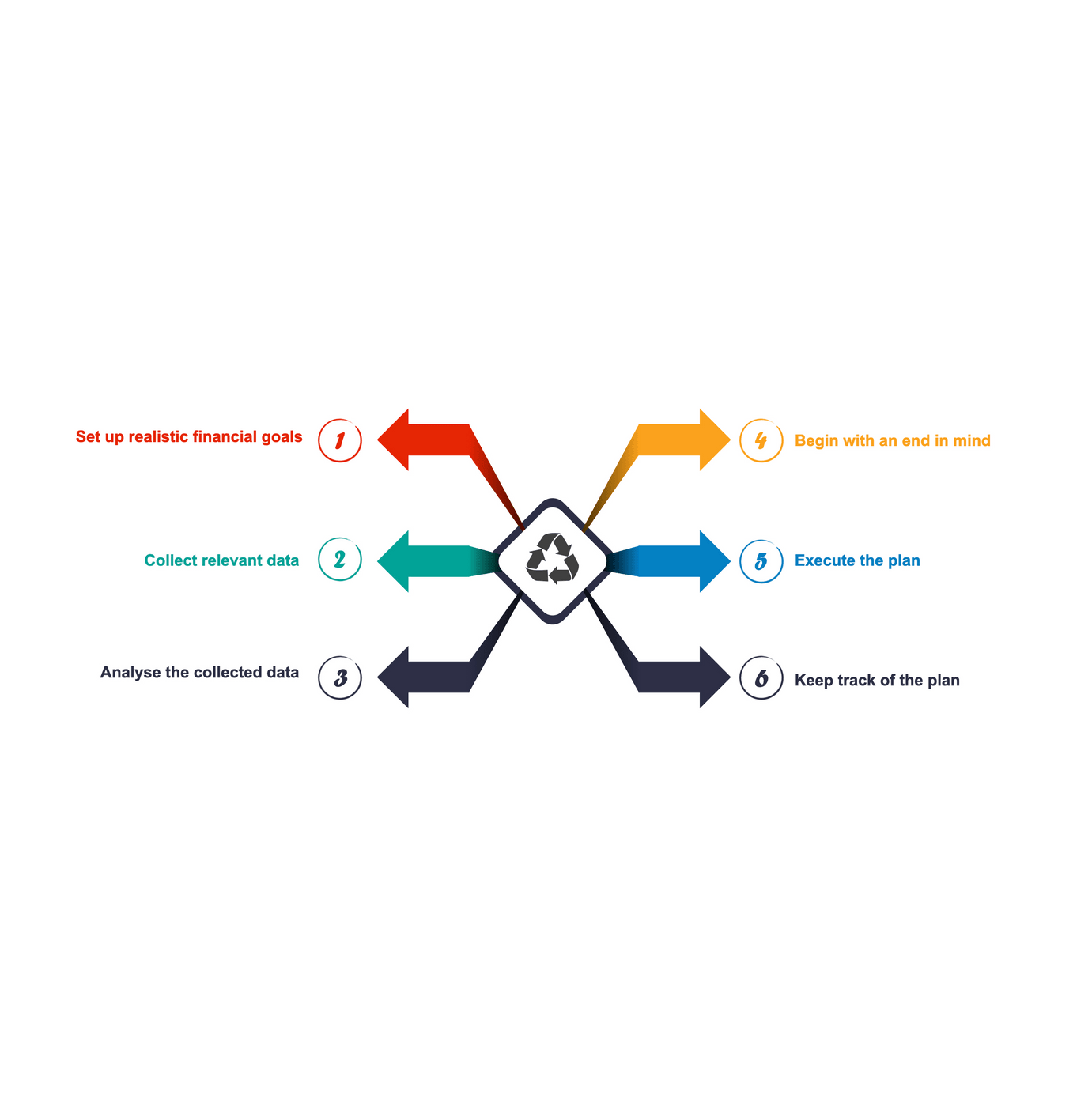

Our Working Process

At the beginning of our working partnership, we will conduct a comprehensive survey and analysis of your current financial situation, with the purpose of building the future that you desire.

Below is our standard financial planning process:

- Set up realistic financial goals – In order to create a successful financial plan, one must have clarity on the goals he wants to achieve.

- Collect relevant data – Besides gathering the objective and personal information of the clients, we will also help to assess their ability and willingness to take risk.

- Analyse the collected data – This is where we will identify the conditions that may help or delay the client’s desire to achieve his financial goals. Wherever is necessary, client will be advised appropriately on what needs to be adjusted in order to move forward.

- Begin with an end in mind – Clients will be presented with good, effective strategies for their consideration.

- Execute the plan – Once the client has been advised properly, this is the moment he has to make the decision to move forward. After all, a financial plan is considered useful to the client only after it is put into action.

- Keep track of the plan – Periodic review involving performance measurement and updates of clients personal and financial situation. Clients should also be informed of changes in economic or tax environment.

We Make Financial Planning

Flawlessly Simple For You & Your Family

Billy Teoh & Sam Lim

Founders Of Grow Wealth Secrets

Our Strategies

Periodic

Review

Managing wealth effectively is not only about growing your assets exponentially. It is about managing risks appropriately.

In GWS, we believe in building long-term relationships with our clients. As you progress through the different stages of life, we will work with you closely, taking good care of the financial needs of yours, as well as your family.

Our working partnership will involve reviewing your insurance and investment portfolios on a regularly basis. We will provide the right advice to you if there is a need to make any necessary adjustment to your financial plan.

Whatever your goals are, the most important question you must ask yourself is, how can you start accumulating more financial resources to achieve your goals?

01

The financial consultants are like a life coach to their clients who will share the simplest and effective formula to accumulate wealth

02

Have Clarity Of Your Goals

03

Control Your Cashflow

04

Start Saving And Investing

As Early As Possible

05

Protect And Diversify Your Assets

important things you should know

Questions And Answers

No we don’t, we believe in promoting financial literacy as a do-good service for Malaysians.